Wednesday, February 18, 2015

Why are foreigners now holding more U.S. debt?

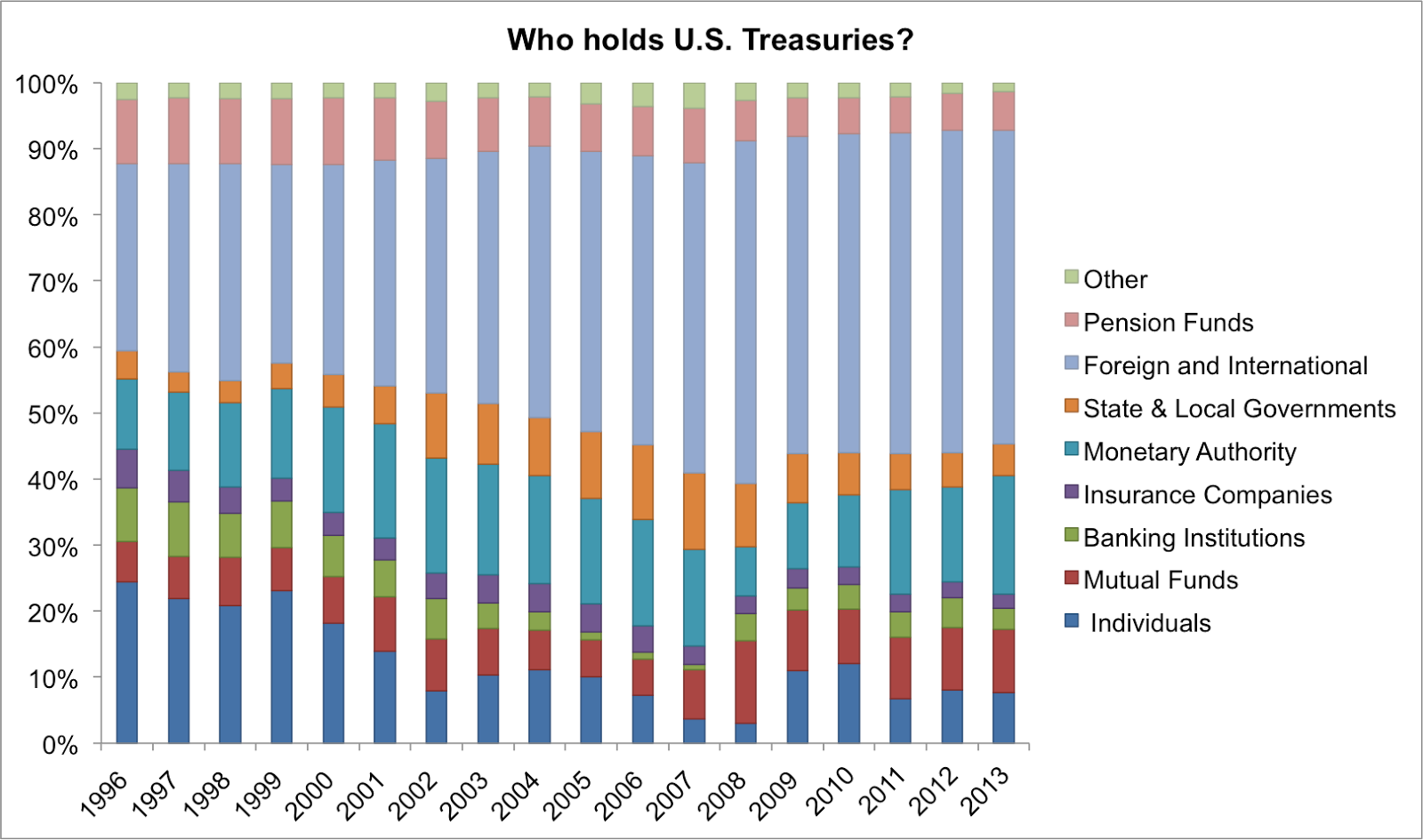

There has been a notable shift in the holders of U.S. Treasuries. As of 1996, individual households held 25% of U.S. Treasuries. As of 2014, individuals hold 7.6% of U.S. Treasuries.

There has been a large increase in the proportion of foreign and international governments that hold U.S. debt. This pattern developed during the market boom 2004-2007. In order to examine what is going on, let's look at dollar values of outstanding debt held by various parties.

The above chart suggest that the growth of U.S. government issued debt was most rapid starting in 2008. The real growth in U.S. Treasuries outstanding is clearly coming from foreign and international holders. Mutual funds and the Monetary authority also notably increased holdings.

The graph suggests that households hold a similar amount of U.S. Treasuries as in the late 1990s. Notice that households held much less in 2007 and 2008. This result is somewhat surprising. On the one hand, the financial panic should have led households to seek safe places to store money. On the other hand, the interest rate cuts may have made other investments look more attractive (not sure which ones?). Banking institutions and foreign governments continued to increase purchases of Treasuries during the boom. Treasuries were an important source of collateral for many repo market relations.

Three thoughts regarding why the ballooning of government debt accelerated in 2008:

First, the supply of government debt may have increase. A Congressional Budget Office report in December 2010 (http://www.cbo.gov/publication/21960) explains that the surge in debt stems from lower tax revenues and higher federal spending related to the recession.

However, this story about higher supply does not explain the differential growth in government debt holdings. The same CBO report notes that "many investors consider federal debt to be an attractive investment, in part because it is essentially free of any risk of default." The largest holders by far are China and Japan. By buying treasuries, China and other countries had a place to park their cash in a safe asset during the financial crisis. Buying bonds also appreciates the dollar relative to other currencies such as the yuan, which helps China's export economy.

Still, why were foreigners the principal buyers of government debt instead of other domestic institutions who also valued safety? Sean Simko, head of fixed-income at SEI Investments in Oaks ($146B AUM), commented in Nov 2014 that "U.S. sovereign debt is attractive [relative] to most other sovereign debt. In a time of uncertainty around the pace of global growth, investors look to Treasuries as an attractive investment." Other countries - EU and China, etc - have been cutting interest rates, making Treasuries relatively higher yielding. Thus, the global "bank" for sovereigns is shifting towards the U.S. in addition to the U.S. desiring to borrow to fund deficits.

Data Source: http://www.sifma.org/

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment