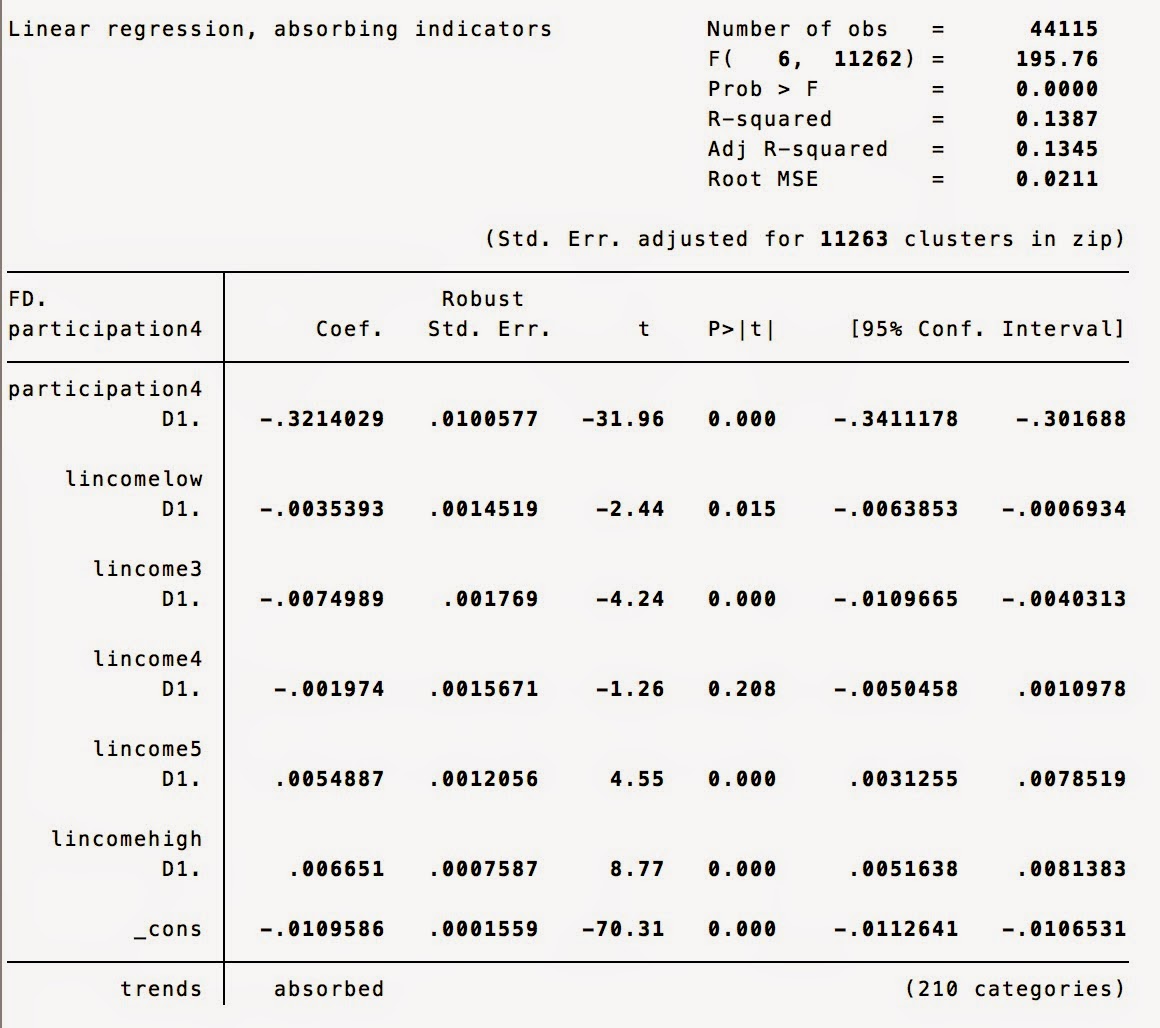

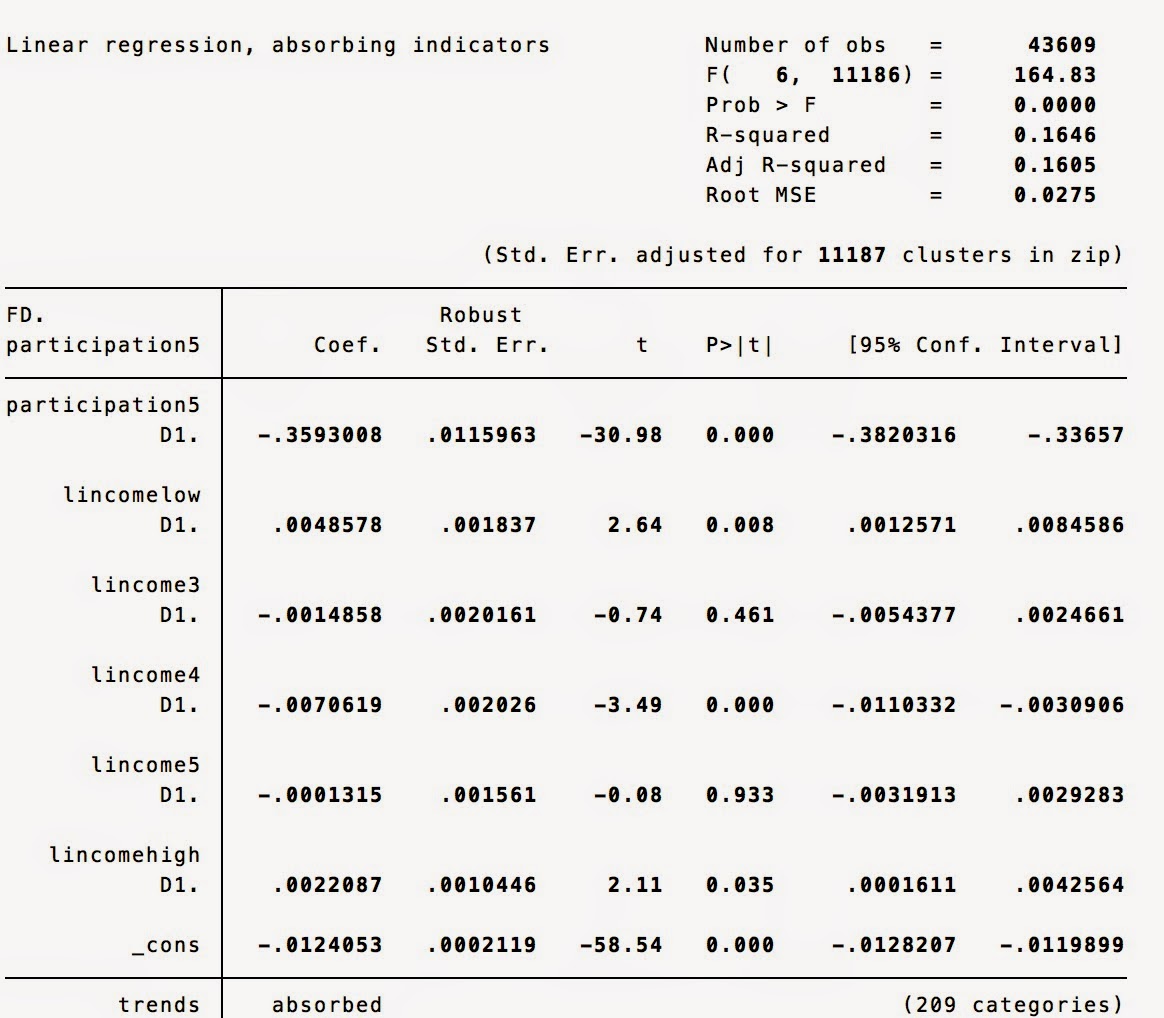

The regression below examines how future differences in participation in the stock market by low income households correlates with current changes in participation by low income households and changes in current incomes for various categories of households by adjusted gross incomes.

The results suggests that when low income households have higher total incomes, they tend to participate more in the stock market. The incomes of the middle class do not really matter for participation of low income households. However, interestingly, the incomes of high income households covary positively with future participation by low income households. The relation is very statistically significant with a t-stat of 16.77. The coefficient is also a magnitude larger than the other coefficients.

The results for changes in participation in the stock market make sense. Changes in the participation of high income households do not seem to matter at all for future changes in the participation of low income households. However, 53% of these high income households already participate, so there may be less change. However, changes in the participation of households earning $25-75k do seem to matter for the participation of low income households.

Perhaps, when tax payers earning over $100k earn more in a given year, they provide more retirement benefits to employees in the form of stock ownership. This would explain why the income of these high earners is associated with higher participation for all income groups (see below regressions). The higher income of high income tax payers do not predict increases in participation for high income tax payers, but this may be again due to the idea that over 50% of them are already earning dividends, so there is no real change on the extensive margin (i.e. new people choosing to invest in the market).

If we don't think of the high income earners as the bosses, then perhaps the high income earners demand the retirement benefits from their firms. The firms may then give the benefits to all employees.

The more individuals earn who earn over $100k, the more participation by households earning $25-50k

The more individuals earn who earn over $100k, the more participation by households earning $50-75k

The more individuals earn who earn over $100k, the more participation by households earning $75-100k

However, the strange result is that the more earned by individuals with incomes over $100k, the less future change in participation in the market. Perhaps, these high earners are already invested in the markets, so there is not much effect of higher incomes on the extensive margin. The highest income individuals have by far the highest stock market participation rates supporting this conclusion.

No comments:

Post a Comment